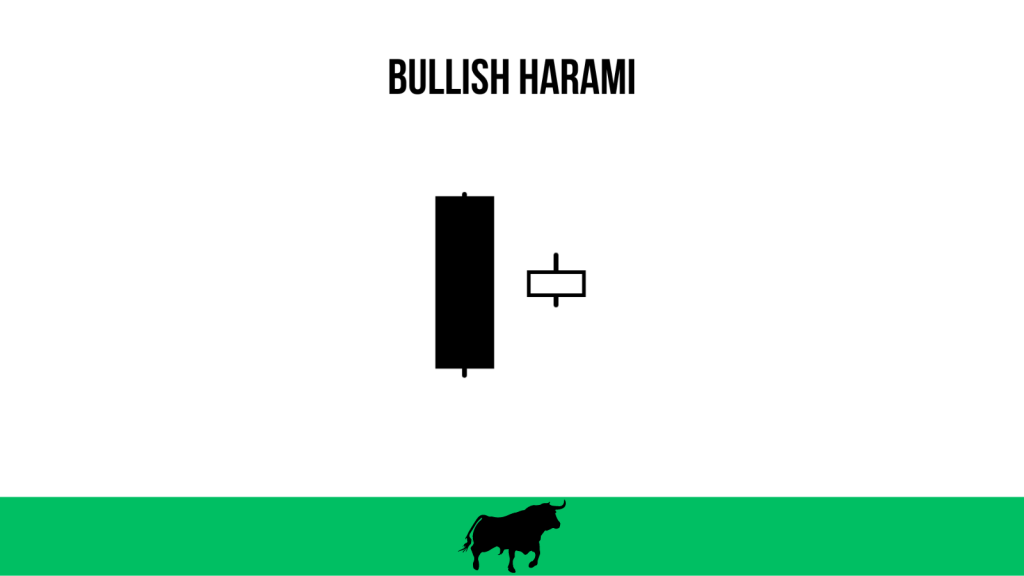

- Sentiment: Bullish

- No. of candles: 2

- Direction: Reversal

What Is The Bullish Harami Japanese Candlestick Pattern?

The Bullish Harami pattern is a bullish reversal pattern that typically forms after a downtrend or during a period of market consolidation.

The Japanese candlestick pattern consists of two candles.

The first candle is a bearish candle with a relatively large body, indicating selling pressure.

The second candle is a bullish candle with a smaller body that is completely contained within the body of the first candle.

This forms the “harami,” which means “pregnant” in Japanese, as the second candle looks like a smaller body within the larger body of the first candle.

What Is The Psychology Behind The Bullish Harami Pattern?

The Bullish Harami pattern reflects a potential shift in market sentiment from bearish to bullish.

Initially, the bears are in control, pushing the price lower with the first bearish candle. However, the appearance of the second, smaller bullish candle suggests that selling pressure is diminishing, and buyers are starting to enter the market.

This pattern indicates a possible loss of momentum for the bears and hints at a potential trend reversal.

How To Trade The Bullish Harami Pattern?

To trade the Bullish Harami pattern, wait for confirmation by a subsequent bullish candle or another technical indicator.

The buy trigger occurs when the price moves and closes above the high of the second bullish candle, confirming the pattern.

Place a stop loss order below the low of the second bullish candle to protect against potential false breakouts or reversals.

As the price moves in your favor, consider using trailing stops or other risk management techniques to lock in profits and minimize potential losses.

Additional Tips

While the Bullish Harami pattern can be a reliable bullish reversal signal, it is essential to use it in conjunction with other technical indicators and chart patterns to confirm the trend change.

Additionally, be aware of the overall market context and consider factors such as support and resistance levels, as well as the strength of the prevailing trend.

Keep in mind that no single pattern can guarantee a trend reversal, and proper risk management is always necessary.

Continue to learn about Japanese candlesticks through books, such as Steve Nison’s “Japanese Candlestick Charting Techniques” and “Beyond Candlesticks.”